Be sure to visit Michael’s website at https://michaelnausscmt.beehiiv.com/

Moving averages are one of the most widely used trading indicators, and for good reason: they offer valuable insights to traders and investors. They can help identify trends, determine fair prices for buying pullbacks, and pinpoint entry and exit points using moving average crossovers.

However, most of these uses only consider the price position in relation to a moving average or the crossing of one moving average over another. What's missing here? Slope!

For instance, we calculate the 200 period moving average by adding the closing prices of the last 200 trading days and divide them by 200. This gives us the precise value of that moving average. But is that number important?

Let's compare that by examining the moving average's slope and what it reveals. If the 200-period MA slopes upwards, it indicates that we either have been trading significantly above that moving average or trading above it for some time.

Which is more important for trading? The exact price of a moving average or its slope?

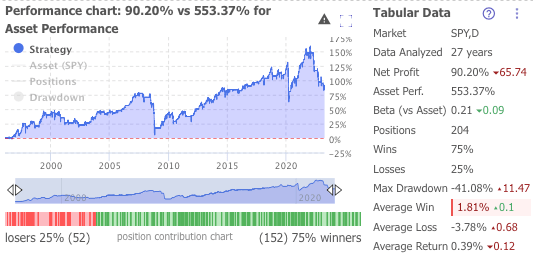

Let's examine some backtests to prove this point. The backtests below use the same system (a simple MACD cross on the SPY). The first backtest is straightforward: buy the SPY on a MACD cross-over and sell it on a cross back down.

The second backtest adds a simple 200-day moving average filter and will only take long trades if the market is above that. It slightly increases returns, demonstrating some small value of ensuring a stock is above a moving average when placing a trade.

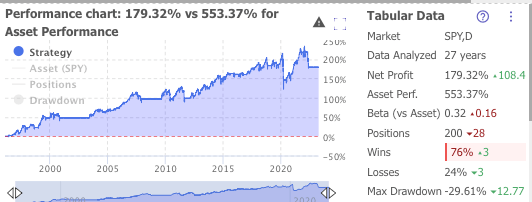

The third backtest is the same as the first two but adds a filter that only trades if the slope of the 200-day moving average is higher, not just if the price is above it. On top of doubling returns, relying on the slope rather than price helps smooth out returns and prevents trading in bearish markets.

Like in my RSI post, the point is to understand the logic behind your technical indicator. If you're looking for an indicator to tell you when to buy or sell, you are probably doing it wrong. Moving averages are an essential technical indicator in trading that can provide valuable insights to traders and investors. However, it's important to understand their limitations and to use them wisely. By examining the slope of a moving average, traders can better understand market trends and avoid trading in bearish markets. Technical indicators like moving averages should be viewed as filters to narrow your trading universe rather than as a sole basis for buying or selling decisions. Ultimately, understanding the logic behind these indicators and using them wisely can help traders make informed decisions and improve their trading outcomes.

Confessions of a Market Maker Substack Report is sponsored by Microefutures / EquitiesETC Trading as well as the Confessions of a Market Maker podcast.