Risk Management in Crypto - Patrick O'Neil (co-founder Coinbusters)

This article reviews several ways to reduce risk in the digital asset (crypto) markets. Crypto is incredibly volatile and tends to swing up and down with the greater technology markets. Risk-management can help smooth the ride and build long-term wealth.

Risk-Management: Debt and Risk

The whole point of adding digital assets to a portfolio is to benefit from their immense volatility. While wild swings up and down can be gut wrenching and outright frightening, volatility is the path to the highest gains over-time. Trending assets that pioneer the coming innovation for our future are likely to change the value of a portfolio greatly in the long run. A portfolio purely of crypto is also likely to be so volatile that the average person cannot handle the everyday ups and downs.

As an example, those who hold a basket of Bitcoin and 3 other large market cap altcoins experienced a change with a 10,000$ portfolio between a net value of 6k-18k on any given day over the last 6 months. This ranges from -40% to positive 80%, this is too much for the average investor. But what if you averaged in after watching the carnage, and blood in the markets? You would likely be up 1-200% on the whole bag. Timing the market however, is extremely challenging, and knowing when to sell is equally difficult.

Investors will witness these crypto assets go from a positive 300% to break even in a matter of weeks. There are however, several strategies to not only mitigate volatility, but to also capitalize on the reward that crypto can provide. The starting point of all of this is to make sure the high interest debts are paid off. If you have a credit card that is crushing you with 15% + interest, or have a personal loan over 5% investing is probably not a great idea.

While I am sure this is not something you want to hear, trust us, we have been there, it is simply not worth the downside of investing when you are paying more than the average yearly stock market returns on your debt. Once most debt is paid off, investing is a great option for long-term growth. There are many options for newer investors to get started, and with moderate crypto exposure.

Younger investors will benefit most from volatility and risk. Afterall, new accounts should seek high yield, or consistent returns. There really is no in between for newer investors, you can either dollar-cost-average tried and true assets, or create a basket of risk adjusted investments. You do not need to be a professional to create long-term wealth.

Risk Management: Balancing Assets

Please remember none of this is financial advice, we seek to help new investors, experienced advisors, and crypto aficionados alike. The first option for balancing assets in a crypto heavy portfolio seeks Bitcoin, Ethereum and stable coins. An example would be on ramping cash into your favorite exchange weekly, and Bitcoin and Ethereum buys on any major red days or weekly. Averaging harder into red days helps make cost basis more favorable, a better cost basis over time provides a better reward when an investor finally sells their long-term assets. We prefer this method to basic weekly buys of the same amount every week.

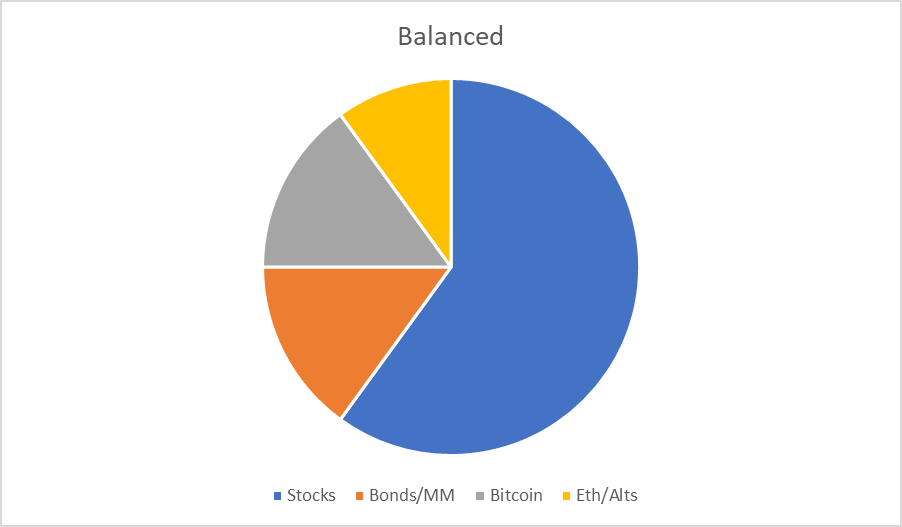

Another option is to add crypto to a more balanced and risk-averse portfolio that includes stocks and money market/bonds. This option would likely have at least 70% of assets in a balanced traditional portfolio. Above is an example of moderate crypto exposure with the basic stock and bond/MM exposure. In this example, utilizing money market makes sense as a means to gain yield on savings while staying liquid, but allows investors to have cash ready for purchases on red days. For more information on money market accounts please check out our article [here].

Generally, the safest bet for the stock section includes mutual funds, like VTSAX and ETFs that track the Dow Jones stocks such as DIA. Individual stocks are also an option but are more risky, so these are for more experienced investors who complete hours of research on each company they invest in.

The first example adds the fuel of crypto to a safer portfolio that will be less volatile over the long-term. Bitcoin, Ethereum and other alts tend to greatly outperform the stock market during overall asset uptrends. If Bitcoin were to uptrend during a bull-market, it would likely engulf a majority of the portfolio over-time allowing the investor to either hold long-term or to take profits into the stocks/bonds/money market to derisk.

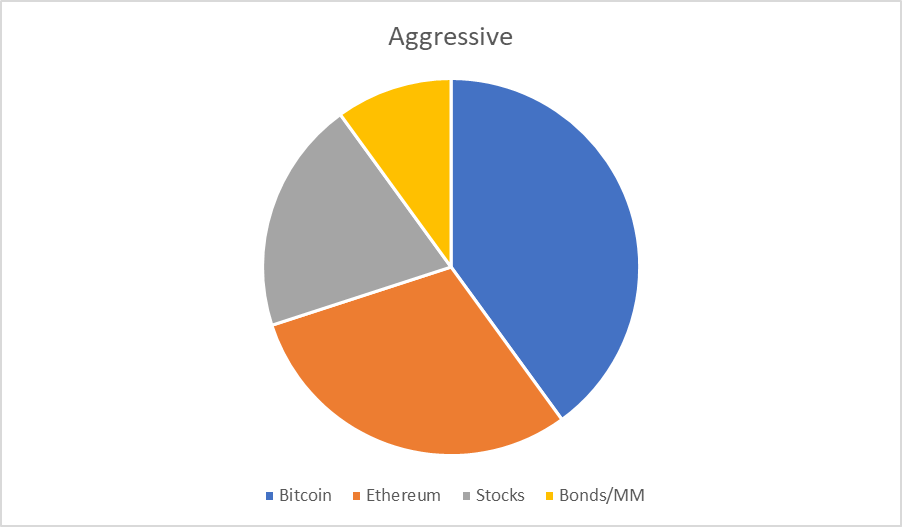

For those who are convinced that crypto will continue to expand and greatly outperform traditional assets a different balance will likely perform well on the 5+ year timeframe. A crypto heavy portfolio will likely outperform the greater asset market. Bitcoin and others also provide the necessary protection these days by allowing self-custody of assets. The key to risk-management for a more aggressive portfolio is to carry a relatively large amount of cash within a yielding account such as money market or short-term bonds. Unfortunately our current economy is so destroyed that long-term bonds yield less than short-term this has to do with the yield curve [1].

The other important factor for an aggressive portfolio is active management, which includes selling on large uptrends and de-risking as the market gets overheated. This portfolio can also simply hold long-term, but he holder will need to be very comfortable with volatility as seen by the difference between the all-time-high of Bitcoin compared to the recent lows. As always do your own research, none of this is financial advice, stay safe out there!

Confessions of a Market Maker Substack Report is sponsored by our friends at Microefutures / EquitiesETC Trading