From The Trading Desk of JJ@vwaptrader1 - Trading in Uncertain Market Conditions

The market has changed drastically. We have to adapt our style of trading and manage risk and expectations......

Beyond The Trades Report is a 3+ times weekly report that breaks down the business & execution of trading & more. If you are not already a subscriber, sign up for free and join thousands who receive it directly in their inbox.

Trading in Uncertain Market Conditions

The market has changed drastically. We have to adapt our style of trading and manage risk and expectations. To thrive in uncertainty follow these rules as a start and remember that risk management is the MOST important thing in these trying times.

Time of day. For new traders with limited skills in trading, the market open in RTH is not wise. Let the market open and let the order flow establish itself. This means letting the big traders do the work and take on the fast volatile new orders that come in off the open. For more seasoned traders who have the skill and account size, size down so you don’t get whipsawed with SIZE. New traders should trade Globex where the price action is slower and you can see moves coming and reacting.

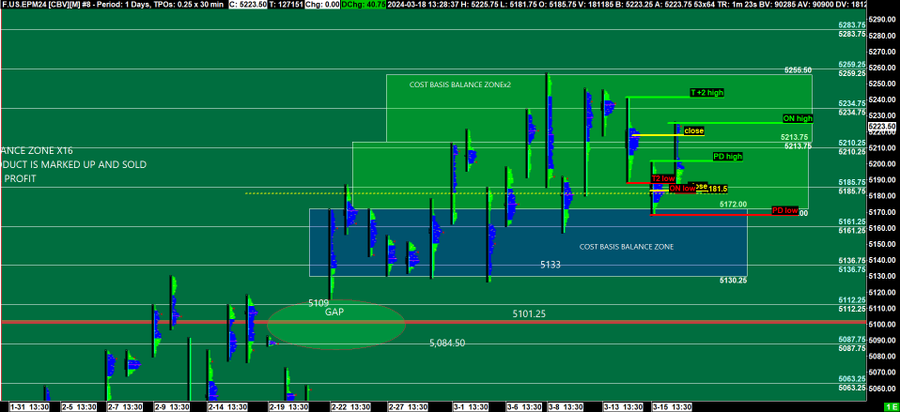

Before trading watch the market. Figure out where inventory is. Where longs or shorts are trapped. Look at the structure and how the price action is. Is the market moving fast or slow? Is the price jumping around or is it stable? Where are the stops? How is price acting at the stops? How many stops are sellouts taking out? Make notes of all this before you execute.

When looking to buy dips remember we have SUPPLY in these markets now. This means the market will take the lowest stop before stabilizing and making a move higher. Short sellers KNOW there is supply and will not bid the market as aggressively as they did last year when there was no SUPPLY.

Make a plan for your out/ safety stop BEFORE you enter a trade so you are not caught off-guard.

Let the size traders work at extremes when markets sell-off, remember there is more supply now, let those big-money accounts take the risk, then look to execute. Being patient is allowing those big-money accounts the time to do their business. Getting in the way means getting unnecessarily stopped out.

Remember it takes TIME to clean up supply after a sell-off. If a market has been over VWAP for 4 hours it is going to take longer than 5 minutes to clean it up when it breaks VWAP as not everyone who is trapped long over it will sell at the same time. Allow time for the sellers to all realize they are trapped and head for the exits.

Be aware of margin call selling when you are taking longs. When markets cannot hold settlement we will have margin calls. When other asset classes sell-off we get cascading margin calls as funds sell whatever they can to avoid sending money to their brokers. What this means for you the retail trader is DON’T GET GREEDY on longs. Sell into strength! If you are long and the market cannot take out the first upper stop above you get out and get paid. Always trail stops when in profit in case of selling that will hit the market like a rogue wave. Your stops are your lifevest, do not go into storms without one.

f you cannot figure out the trade, wait and watch the market will tell you what is going on. Resist the urge to jump in and boredom trade or revenge trade. If you have trouble doing this, reach out to one of the moderators in our room. We are here to help.

Use Globex trading to put together information so you can build trades in RTH. Be disciplined and always make sure you think risk before reward. The markets are not going to treat bad decisions and greed kindly. Govern yourselves accordingly.

If you are having trouble with a market, size down and trade less. The emotional wear and tear of losing money and blowing up accounts can be avoided by not pushing trades. We have to be vigilant and smart now. Anyone can make money in a bull market with no supply. We have a two-sided market now so remember we have to be smarter, faster executing, and more patient to allow trades to develop. Do not get upset if you miss a trade because you hesitated and chase it. There will be thousands of trades for you.

Admit you are wrong when you get it wrong and get out fast! Do not let that “ oh it may turn” get in your head. Be savage and cut losses quickly this preserves capital. If you get stopped out 3 times take a break and review what you got wrong.

Stay flexible and learn to adapt to different market dynamics. We will see many in the upcoming weeks.

Reminder that @vwaptrader1 teaches and trades live at Microefutures Trading